Secure Your Legacy in Real Estate

Image Gallery

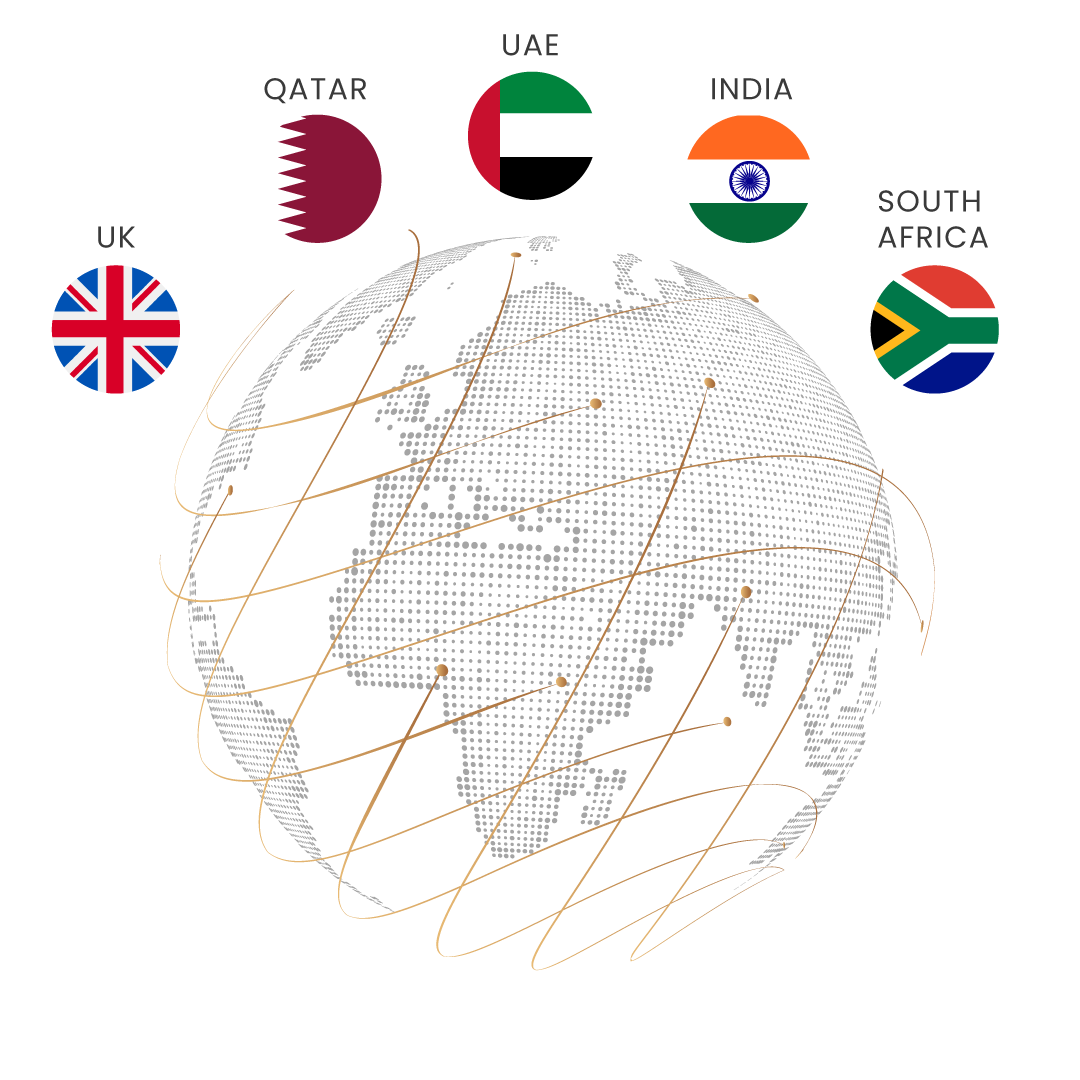

Global Real Estate Local Expertise.

Cross Borders, One Brand!

Partners in Developers

The Investor's Edit

Ready to make your Next Global Move ?

Secure Your Legacy in Real Estate Exclusive, high-return opportunities across UAE, UK, Qatar, India and South Africa curated for the discerning global investor. Global Real Estate Local Expertise. As a full service boutique Real Estate Agency in UAE with an ambitious outlook, our philosophy is to ensure an insightful approach to the real estate sector for the benefit of our clients. We ensure that our

founders, directors, consultants, and support staff are aligned to deliver innovative and intelligent services in a warm and welcoming manner. Banke is your premier Real Estate Agency for smart property investments. With our global network, we offer access to the most lucrative markets, helping you secure a profitable future in real estate. Cross Borders, One Brand! We operate globally with fully-owned offices in UAE, UK,

India, Qatar, and South Africa. Banke International Properties connects you to premium real estate where it matters most. Whether it's a luxury home in UAE, an investment in London, or a dream property in Mumbai or Doha - we market it, sell it, and deliver results across borders. Partners in Developers The Investor's Edit Curated Market Insights and Global Analysis. Ready to make your Next

Global Move ? Our global team is on standby to connect you with exclusive, high-yield properties in the world's most dynamic markets.

Banke International Properties helps buyers, sellers, and investors with premium real estate services across Dubai and the UAE. Banke International Properties supports buyers, sellers, landlords, tenants, and investors with structured guidance across listing strategy, market positioning, legal documentation, and transaction execution.

This page focuses on UAE real estate agency, Dubai real estate, buy property UAE, sell property UAE, property investment, Banke International Properties. It helps visitors evaluate locations, understand service scope, compare opportunities, and connect with an experienced advisory team for next steps. You can use this route to review key decision factors before scheduling a consultation.

Clients typically use these guides to shortlist communities, check pricing direction, review financing options, plan due diligence, and prepare for offer management. The objective is to provide clear, practical information that supports confident property decisions across UAE and international markets where Banke operates.

Along with strategic advice, Banke teams coordinate marketing exposure, buyer and tenant outreach, negotiation support, and post-deal handover guidance. This route is part of the wider knowledge base that keeps prospects informed before they move forward with a sale, lease, purchase, or investment transaction.

Key Topics

- UAE real estate agency

- Dubai real estate

- buy property UAE

- sell property UAE

- property investment

- Banke International Properties