What Is a DLD Waiver and How to Use It in 2025

What Is a DLD Waiver?

Why Is the DLD Waiver Dubai So Popular in 2025?

How Much Can You Save With a DLD Waiver in Dubai?

Who Offers DLD Waivers in Dubai?

Where to Find DLD Waiver Offers in 2025?

How to Use a DLD Waiver in Dubai: Step-by-Step

1. Confirm the Offer with the Developer

2. Understand the Payment Terms

3. Read the Sales and Purchase Agreement (SPA)

4. Work with a Trusted Real Estate Agent

5. Register the Property

Important Tips to Consider in 2025

Are DLD Waivers Available on Secondary Properties?

Why Investors Should Take Advantage of DLD Waivers in 2025

Conclusion

What Is a DLD Waiver and How to Use It in 2025 In the fast-paced world of Dubai real estate, buyers are constantly on the lookout for offers that reduce their overall property investment cost. One of the most talked-about benefits in recent years is the DLD waiver. If you’re looking to buy a property in the emirate, understanding what a DLD waiver Dubai entails

in 2025 can give you a major financial advantage. Let’s explore everything you need to know about the DLD waiver, its benefits, and how to take full advantage of it in 2025. What Is a DLD Waiver? DLD stands for Dubai Land Department, the government authority responsible for overseeing property transactions, registrations, and real estate legislation in Dubai. When you purchase property in Dubai, the

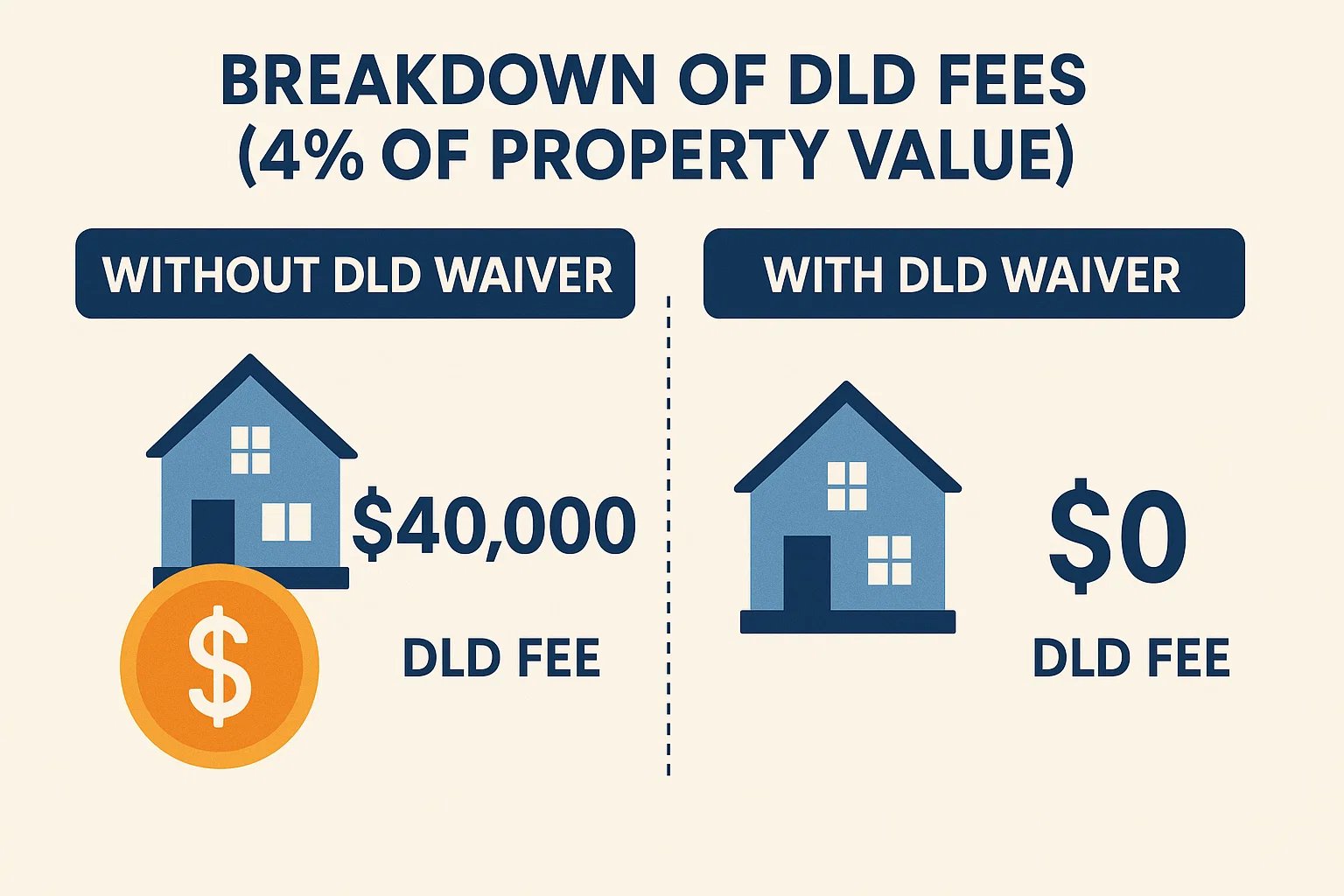

DLD charges a standard 4% fee of the property’s value. This fee must typically be paid upfront during the transaction and adds a significant cost burden to the buyer. A DLD waiver refers to a special incentive or offer where this 4% fee is either partially or completely waived off, typically by the developer as part of a promotional campaign. In many cases, the developer

covers the DLD fee on behalf of the buyer, reducing the financial burden and making the investment more attractive. Why Is the DLD Waiver Dubai So Popular in 2025? As of 2025, the DLD waiver Dubai trend is stronger than ever. The property market continues to flourish with increasing demand from both local and international investors. To remain competitive and attract more buyers, many real

estate developers are offering full or partial DLD waivers as part of their sales strategy. Here’s why DLD waivers are so appealing: Immediate cost savings Lower upfront payment requirements Greater flexibility in budget planning Encouragement to invest in premium or off-plan properties More accessible investment options for first-time buyers With rising interest in Dubai’s real estate from countries like India, the UK, Russia, and China,

these waivers play a key role in driving foreign direct investment. How Much Can You Save With a DLD Waiver in Dubai? Let’s consider a simple example to illustrate potential savings: Property Value : AED 1,500,000 DLD Fee (4%) : AED 60,000 With a DLD waiver , that AED 60,000 is saved or covered by the developer—directly reducing your upfront investment. These savings can be

redirected towards furnishing the property, paying for service charges, or even upgrading to a higher-value unit. Who Offers DLD Waivers in Dubai? Most top developers in Dubai offer DLD waivers on selected projects, especially during new launches, property exhibitions, and promotional events. Some of the well-known names include: Emaar Properties Damac Properties Sobha Realty Nakheel Azizi Developments Danube Binghatti Meraas These developers often bundle the

DLD waiver Dubai offers with other incentives like post-handover payment plans, service charge waivers, or furnished units. Where to Find DLD Waiver Offers in 2025? In 2025, staying informed is the key to grabbing the best DLD waiver Dubai deals. Here’s how you can find them: Real Estate Exhibitions and Events Dubai hosts multiple property shows throughout the year where developers launch new projects with

exciting offers, including DLD waivers. Developer Websites Visit official websites of top developers to explore their current offers and incentives. Authorized Real Estate Agencies Many brokers and agencies are directly partnered with developers and have early or exclusive access to DLD waiver projects. Online Property Portals Websites like Bayut, Property Finder, and Dubizzle often highlight properties with 0% DLD fee or DLD waiver promotions. Social

Media Follow reputable real estate pages and property influencers in Dubai. They often share ongoing offers, including DLD waiver Dubai 2025 updates. How to Use a DLD Waiver in Dubai: Step-by-Step If you’ve found a project offering a DLD waiver in 2025, here’s how to make use of it: 1. Confirm the Offer with the Developer Ensure the DLD waiver is officially part of the

promotion and check whether it’s a full or partial waiver. 2. Understand the Payment Terms Sometimes, developers cover the DLD fee only if a certain percentage of the property value is paid within a specific timeframe. 3. Read the Sales and Purchase Agreement (SPA) The waiver must be clearly mentioned in your SPA or MoU. It should state that the DLD charges are covered by

the developer. 4. Work with a Trusted Real Estate Agent A licensed broker can help you verify the offer, negotiate better terms, and ensure all legal paperwork is in order. 5. Register the Property Although the fee is waived, the property must still be registered with the DLD to obtain the title deed. The developer handles this process if they’re offering the waiver. Important Tips

Key Topics

- DLD Waiver Dubai: Save 4% on Property Fees in 2025